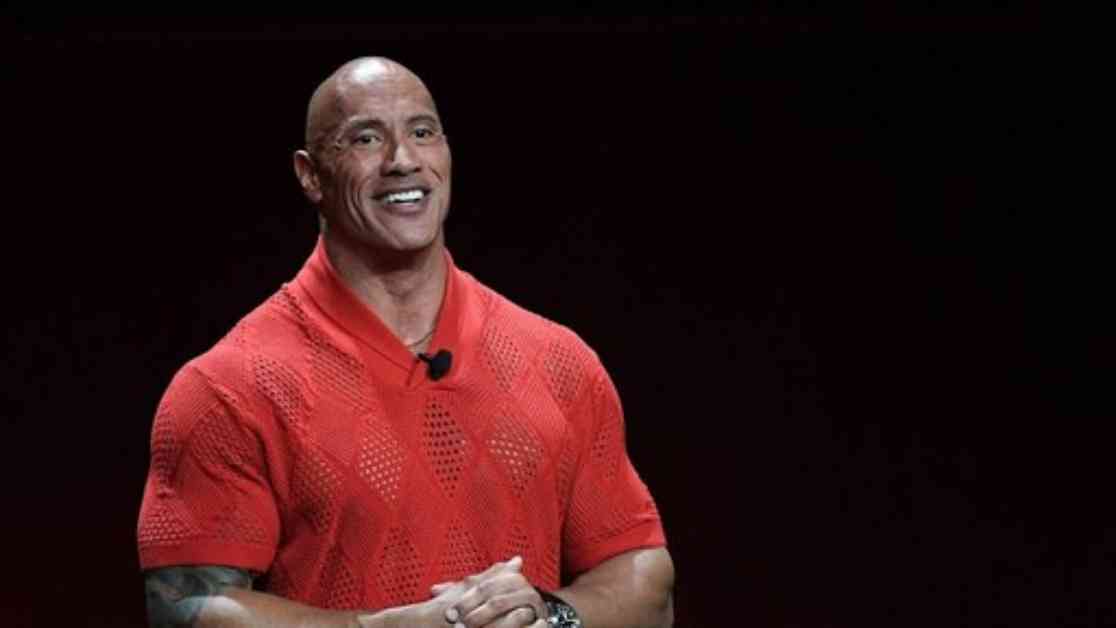

Disney has found its lead actress for the live-action version of the animated film ‘Moana’ in Australian Catherine Laga’aia (17). She will star in the film alongside Hollywood star Dwayne – The Rock – Johnson (52), who will play the role of father Maui, a character he voiced in the animated film. “I am very excited to embrace this character, as Moana is one of my favorites,” said Catherine in a statement. The actress has personal ties to the Polynesian island group where the film is set, as her grandparents are from Samoa. “I am honored to have the opportunity to showcase Samoa and all the islands in the Pacific, and to represent young girls who look like me.”

The animated film Moana (2016) follows the story of the daughter of a village leader who is chosen to reunite a mystical relic with a goddess. The film tells an original story based on Polynesian myths. The production for the live-action film will begin in the summer of 2026. In addition to the live-action film, Disney has announced a sequel to the animated film Moana, set to release on November 27th. “I can’t wait for the fans to see the film, the technology, the effects,” said Dwayne. “We thought, if we are making a sequel to something so beloved, let’s go all out.”

The news of Catherine Laga’aia being cast as the lead actress has generated excitement among fans of the original animated film. Many are eager to see her bring the character of Moana to life on the big screen. The decision to cast an actress with Polynesian roots has also been praised for its commitment to authentic representation and diversity in Hollywood. This casting choice not only reflects the cultural background of the character but also provides an opportunity for young girls of Polynesian descent to see themselves represented in a major Disney production.

The success of the animated film Moana has set high expectations for the upcoming live-action adaptation. Fans are looking forward to seeing how the story will be translated to the big screen and how the characters will be portrayed in live-action. With the combination of talented actors, advanced technology, and a captivating storyline, the live-action version of Moana has the potential to be a hit among audiences of all ages.

Overall, the casting of Catherine Laga’aia as the lead actress for the live-action film Moana has sparked anticipation and interest in the upcoming adaptation. As production begins and more details are revealed, fans will be eagerly awaiting the release of the film to see how this beloved animated story is brought to life in a new and exciting way.